Welcome to the first Deep Dive of the substack!

Today we will dive into Games Workshop, a geeky niche business with such a high return on invested capital.

Alert: We are going to be talking about fantasy miniatures and, even though I will try to synthesize it as much as I can, a cup of coffee is strongly recommended.

Before beginning with the thesis, I want to clarify that I am not a GAW customer and everything I know about the company and its lore is just by investigating whether could be a great investment.

Let's start!

1. Introduction

History and context

Games Workshop (GAW) was founded by three board game fanatics who started selling handmade wooden games from London. These founders were Ian Livingstone, Steve Jackson and John Peake.

After seeing there was a strong demand for their products, they decided to run a chain of stores to sell them until they finally created Games Workshop in 1975.

In 1981 the company helped on the foundation of Citadel Miniatures Limited, a Nottinghamshire-based manufacturer of metal miniatures and its main manufacturer up to date.

Tom Kirby (Ex-Chairman of the company) started working in the business in 1986, he rapidly fell in love with it and orchestrated a management buy out (MBO) in 1991. Three years later the company went public in the London stock exchange in 1994.

The main purpose of GAW has always been the same: to be the company that makes the best fantasy miniatures in the world to engage and inspire their customers.

GAW is the leading company in the design, production and sale of miniatures for board games in the fantasy and science fiction category. It operates in a monopoly and even though it has been on the same niche operating with fantasy miniatures and creating fantasy content for about 50 years it has not always been interesting under an investor scope, but that changed in 2015.

¿What did happen in 2015 so?

What happened was that Kevin Rountree, the CFO of the company, was elected to be the new CEO. This was such a turning point because up to date, the company was suffering a stagnation process, to summarize it briefly, there was a combination of saturation of the board game rules and the fandom felt not listened at all.

Kevin Rountree made controversial decisions, he initiated a new strategic plan and basically gave to the customers what they awaited desperately.

Note: With the purpose of no saturation, I will skip the specific changes Kevin introduced on this part and you will be able to find them on the second part of the thesis.

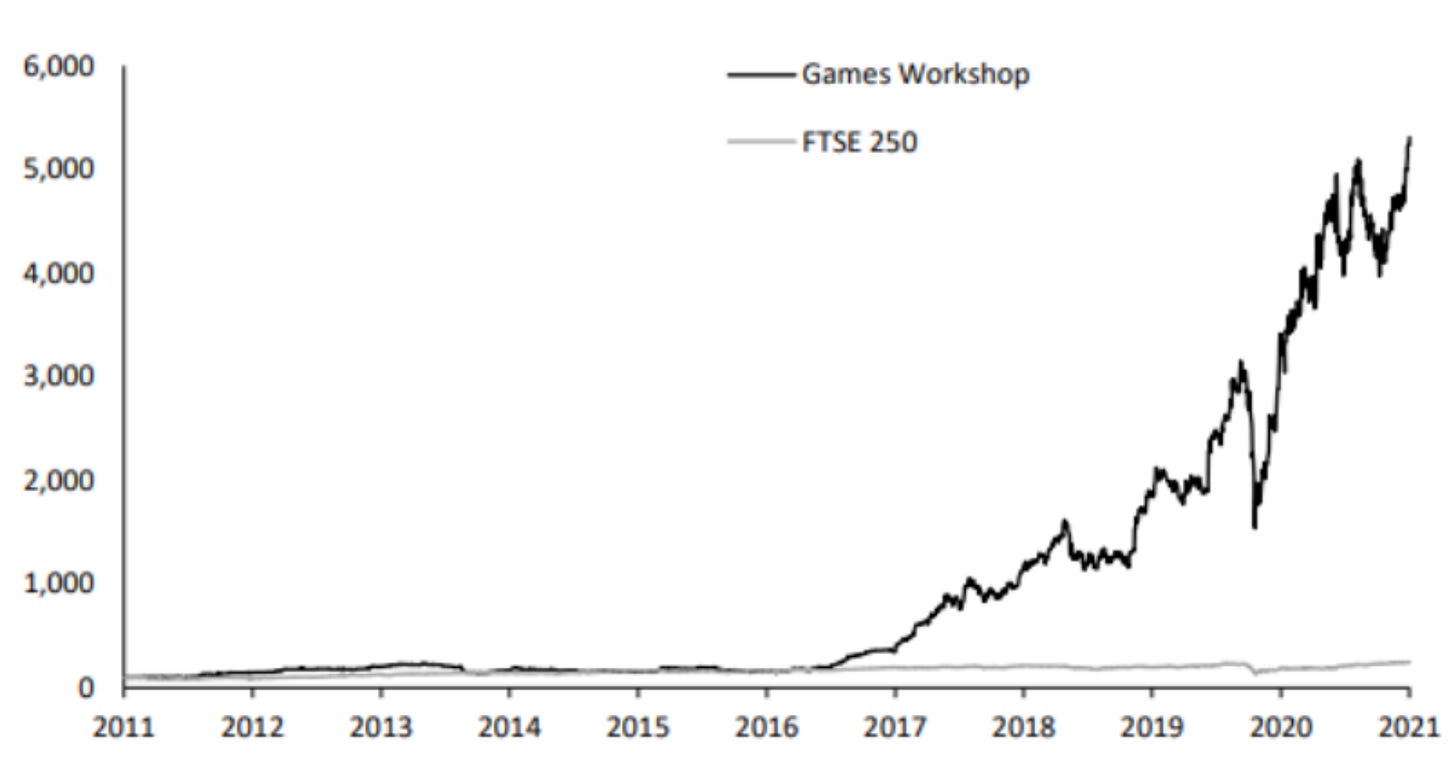

As sometimes numbers are self-explanatory, here is some napkin math to evaluate Rountree's execution:

Since Kevin's promotion, during 8 years GAW's sales multiplied by more than 3x, its Operating profit expanded from 24% to 36% and multiplied by 9x, and its net profit multiplied by 10 times without changing the number of outstanding shares.

With that execution, GAW's stock did not last to skyrocket and its price return over the period has been a wonderful 37,5% CAGR for its shareholders without taking dividends into consideration.

Source: Games Workshop 10-K

2. Diving into the lore

2.1. More context

GAW is the company behind the brand Warhammer, but it is so much more than just a miniatures manufacturing company, it is also the creator of the fantasy narratives associated with the miniatures and seems more like a media content producer than a manufacturing one.

The cycle of use of the miniatures not only includes their use on a battlefield, but also includes their assembly, painting and customization, and also requires presence to be played. Yes, you are reading right, the company sells its products without being assembled and that is one of the reasons that explain its huge gross margin (68%).

The nerdy hobby turns out to be really expensive and very time consuming. It is important to understand that GAW's customer profile is such a special type: the one that does not hesitate to spend more than a thousand euros per year on his armies and may employ many hours of his free time playing, commenting updates or consuming GAW's content. The average age range of its costumers is around 30-60/70 years old.

The battle games are performed on-site into GAW stores and can last for hours. This aspect is relevant because playing in person implies the development of what they call "sense of comradeship", this is basically a sense of belonging to the brand motivated by the experiences and the friends made because of the hobby, and that generally immerses players into the universe more and more building a virtuous cycle.

Battles are not as easy as you may think, here are a bunch of characteristics of its most played game (Warhammer 40k):

You have to structure an army based on a maximum point cost system. Let's say the army you create has to have 1500-2000 points of cost (not talking about the price here, the price of each miniature is independent).

Each miniature has its own point cost (e.i. marine's tank costs 200/300 points) and has different attributes (defense, range of attack, etc) so you have to spend time strategically thinking how to create a compensated army to be able to succeed in a battle against each type of rival. Here the metagame and the constant rebalancing of the units play an important role.

The army's movements have to be performed coherently and the game is played with two dices so the battle depends on a luck factor.

Each turn is divided into several phases that the player must execute.

Long story short, it is not just a simple board game. If you want to go into more detail on this, here you are GAW's oficial introduction guide: Warhammer Guide

One of the most important points here is that playing an on-site battle is the last part of a whole time consuming process. First, you have to know the lore and spend time getting familiar with it, then you buy miniatures that are unassembled and unpainted, then you assemble them and spend time learning how to paint and customize those miniatures, the next step is to study the rules of the board game and organize your army strategically for battles, and finally, you go to a store to play.

The company is present in every part of the process, it is vertically integrated and manufactures its miniatures under two different brands:

Citadel Miniatures - Under this brand GAW manufactures its plastic miniatures to satisfy the demand of less premium customers with more affordable prices but with lower quality.

Forge World - Under this brand the company manufactures its high quality miniatures made of resin oriented for premium users. The prices under Forge World are substantially higher, there even are single products that cost over 1500£.

Source: Forge World Website

The price of a complete army may be around 1500/2000 Eur, so taking into consideration the whole demand of time the process requires and the expensive price of the hobby, we can conclude this is not a hobby for everyone.

About the expensive prices charged the management point of view is the following:

"People who are interested in collecting fantasy miniatures will choose the best quality and be prepared to pay what they are worth."

Last, before diving into the company's brands, the reader must know that is so complicated to be updated with the Lore and follow other friend's rhythm if you do not spend a big part of your free time on the hobby. It is a kind of "in or out" game because as we are going to see next, the lore is immense!

2.2. LORE: Universe and Brands

IMPORTANT: Before diving into GAW's universe and its different brands and not to lose the reader in such a dense text, here is the main takeaway of this section: The most important competitive advantage of the company is its brand and the following paragraphs only have an explanatory purpose to let the reader understand why its brand and its value proposal is not replicable.

The big picture of GAW's universes is simple, there are two universes:

Warhammer 40K Universe

Warhammer Fantasy Universe

There are remarkable differences between each universe. We can define the Warhammer 40K lore as darkgreen, that means it is gore content where death and violence are so present and its atmosphere is based on a much more futurist style. On the other hand, Fantasy universe is more similar to the well known world of Lord of the Rings, less futurist than the other, with more known mythological creatures.

GAW operates different brands although only three of them are currently operative:

Warhammer 40K: narrates epic battles between armies of heroes, villains and monsters in a futurist context.

Warhammer Age of Sigmar (AOS): based on the story of four kingdoms (Order, Chaos, Death, and Destruction) trying to conquer the mortal realms.

Warhammer 30K (The Horus Heresy): narrates the story of the primarches (emperor's descendants).

The company used to operate another brand called Warhammer Fantasy but this one was crippled by Kevin Rountree after his promotion to CEO in 2015.

Note: The company also holds the license to exploit the Lord of the Rings and The Hobbit IP by producing board games and miniatures.

Using the previous big picture segmentation of the universes and classifying each of its brands according to the universe in which each one operates, we obtain the following:

Warhammer 40K Universe

Brands into the universe:

Warhammer 40K

The Horus Heresy (30K)

Warhammer Fantasy Universe

Brands into the universe:

Fantasy (Old World)

Warhammer Age of Sigmar (AOS)

Time chart with the universes and releases of the different editions of the Games Workshop brands. Source: @luisferpob Twitter

A crucial aspect here is that not all brands are equally important nor have the same number of followers, Warhammer 40K is clearly the main vessel of the fleet with the biggest impact on sales and that is why we will dive more into it.

Warhammer 40K:

The stories of this universe are set 40 millennia after the birth of the emperor which marks the year 0 of the universe as it is known today, so the brand is known as Warhammer 40K or Warhammer 40000 and tells the story of humanity fighting for its survival against monsters and villains. The emperor is one of the pillars of this fantastic universe, his birth was the result of the sacrifice of ancient shamans for the good of humanity who were later reincarnated in this immortal figure. Currently the emperor is still alive although in a conscious state and requires the sacrifice of 1000 lives daily to keep him alive. This may serve as a hint to understand how gore the stories are and to understand the typical style of the narratives.

Warhammer 40K lore is immense, there are more than 300 novels written about this brand since its inception in 1987, and there are so many factions within it, each one with its story.

The main factions are: Imperium of Man, Space Marines, Adeptus Mechanicus, Chaos, Craftworld Aeldari, Drukhari, Orks, Tyranids, Necrons and Tau Empire. But it does not end there, there are even subfactions into each faction (e.i. space marines converted to chaos). Sometimes is easier to comprehend its size by comparison, for example, in Star Wars there are two factions: Jedi and Sith, right? well, just under the brand Warhammer 40K you can find around 20 factions or more taking subfactions into consideration. Wait for a second and imagine the possibilities of creating fantasy content with all those factions, and this is only one group's brand, this is crazy! We are possibly talking about the biggest content of intelectual property up to date.

With the other brands the result is the same but on a smaller scale. For the sake of not making the explanation too long, we will not go into more detail with the other brands as the goal is simply to make the reader understand the size of the IP and the great story generation capacity of the company.

GAW has been producing fantasy stories for decades, its know-how and its way to satisfy the demand of fantasy content have its costumers completely hooked. The company operates in a monopoly because it is practically impossible to create a fantasy universe with decades of depth as GAWs, it would take so much time to elaborate it and competitors would need to spend a lot of money just trying to hit the spot.

3. Business Model

3.1. Revenue Segmentation

The business generates income throughout four channels: Retail, Trade, Online and Licensing.

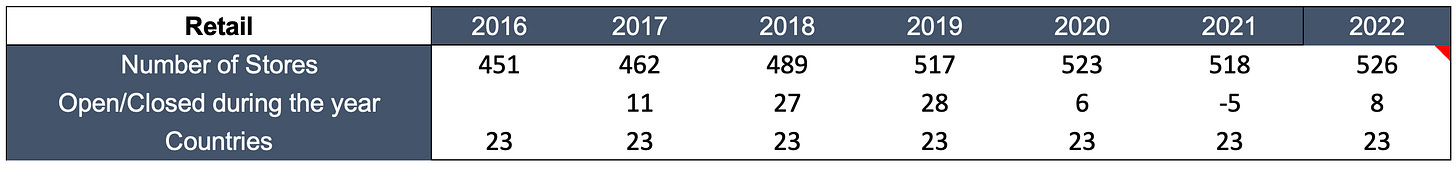

Retail: This type of income includes GAW sales from its own stores. Currently there are 526 shops of which 399 are single staff stores (SSS).

The purpose of this business segment is to serve as introduction to the hobby for new customers, where GAW employees teach them how to play and how to paint miniatures.

The products most sold are starter kits and you cannot find the whole catalog of miniatures in the store even though there is direct access to the company's website to order.

This segment has the lowest margin of all the segments (around 8-10%) but is essential to keep introducing new customers that may become recurrent revenue in the future.

Retail Stores. Source: Own elaboration.

Trade: This type of income includes GAW sales to third party retailers that then sell GAW products to customers. Currently there are 6500 third party stores.

This segment is so much more profitable than Retail and its operating margin is around 30-35%.

These third party stores generally offer miniatures with some sort of discount (10-15%) relative to GAW stores and that is the reason why customers already familiarized with the hobby normally buy products there.

Third Party Stores. Source: Own elaboration.

Online: This is income generated by sales through GAW's website.

This segment is really profitable and its margin is over 60%.Licensing: This is royalties received by the company for the assignment of its IP for the creation of video games, TV series, etc. These represent almost no extra cost for the company and allow the group to enhance their brands and provide more visibility through these video games and TV series.

Licensing is the more unpredictable of four channels because it relies on the deals made using the IP.

This segment is extremely profitable with an operating margin close to 90-95% and it has the following segmentation: 68% PC & Console games, 7% Mobile, 25% Other. It currently generates about 20-25M per year.

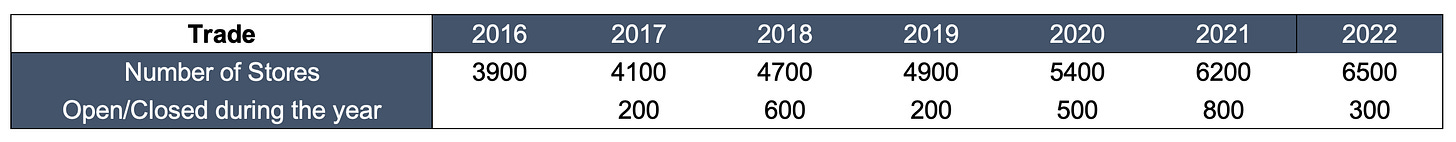

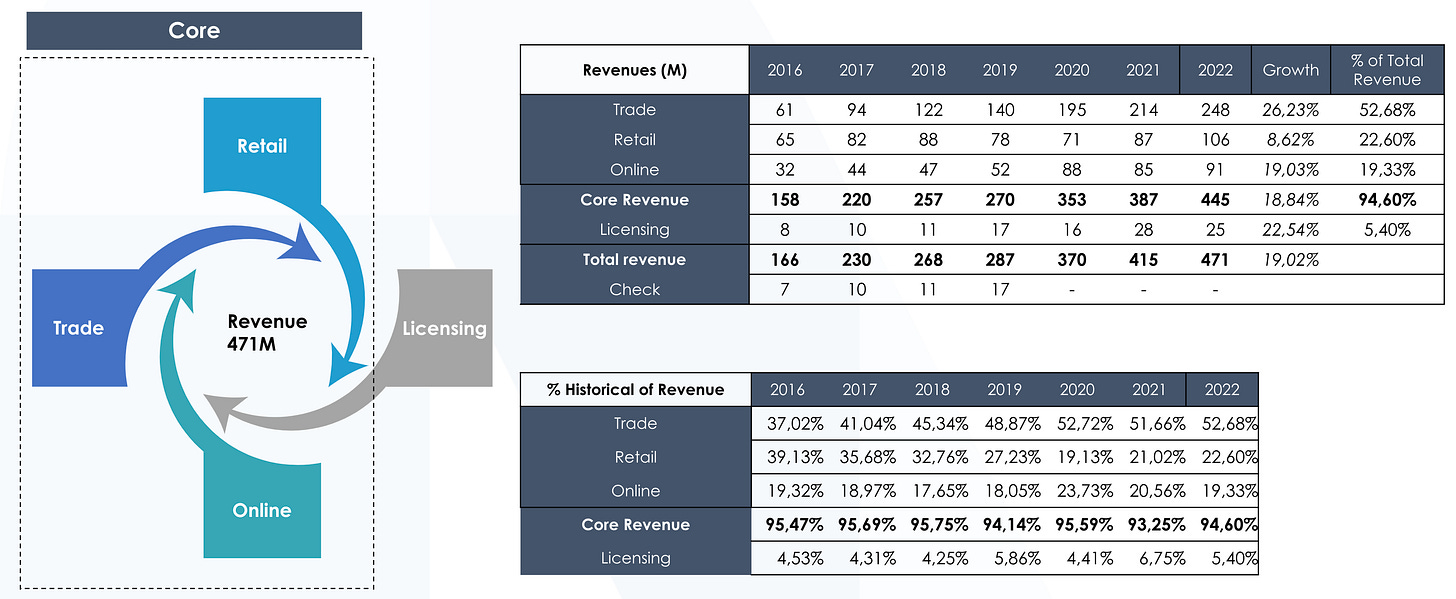

Once viewed the four different ways of income generation, we will make the following distinction: Retail, Trade and Online compose what we will call Core Revenue and we will treat the licensing revenue separately because of its unpredictable nature.

Source: Own elaboration with 10-K Data

Note: The company’s fiscal year ends in May.

GAW's total revenue has been growing at an incredible 19,02% CAGR and nowadays the company makes almost half a billion in revenues.

Table 1 shows the weight of each segment as a % of total revenue. If we take a look we can see Trade represents more than half of total revenue per year (52,68%), Retail and Online represent a similar weight of total revenue (22,6% and 19,33%) and licensing counts for about a 5,4%.

Taking into consideration the previous distinction, Core Revenue represents almost 95% of company's total revenue.

The same table shows the different rates of growth for each type of income generation and we can see Trade grew at a 26,23%, Retail grew at high single digit rate (8,62%) and Online at 19,03%. The Core Revenue grew at 18,84% during the period and Licensing grew above that rate (22,54%).

The second table shows how the weight of each segment as a % of total revenue changed historically. It is noted that Trade increased its weight considerably and Retail decreased, Online segment remained stable and Licensing did the same.

Here is the key point, as the operating margin of each segment is different, the organic evolution of the business with higher growth in more profitable segments have expanded GAW's operating margin considerably from 24,3% to 36,2%. The bigger weight of the Trade segment and the reduction of the Retail segment as a % of total revenue mostly contributed to this margin expansion.

Operating margins by segment. Source: Own elaboration.

Note: GAW changed in 2019 the way of reporting its numbers and we do not have each segment margin specified anymore, anyway, past numbers can serve as an indication of current profitability.

It may seem there was a reduction in margins over the last few years and the business is less profitable than before, but this margin contraction has an explanation: COVID-19. Due to pandemic and lockdowns, Retail stores suffered the most and both Trade and especially Online showed abnormal and unsustainable growth increasing margins considerably. The last margin is already normalized so we can conclude that those margins of those years (20-21’) were artificially inflated and we should not expect them to return to those levels, at least for now.

In the following table we can see YoY growth of each segment where the growth mentioned above is highlighted:

Source: Own elaboration

The prices of the miniatures rise around 3-4 % each year approximately (lately even more!) so the other part of revenue growth is basically volume and my estimations are that a huge % of this volume increase is recurrent revenue from older customers because of the complicated nature of this type of hobby and because we can see Retail segment as a proxy of new entrants.

Last but not least, geographic segmentation of the company is practically based on EEUU, Europe and UK (almost 90% of total revenue). The group has 78% of its sales outside UK and does not use any currency hedges.

Source: Own elaboration.

3.2. Business Model Analysis

Strong increases in sales are directly linked to the launching of new editions of the different Lore brands. As mentioned earlier, the launch of Warhammer 40K edition is normally the financial high point until the next edition, but what really is an edition?

An edition is a renovation of the game, with a change of miniatures, change of rules and modifications that impact on the game.

That said, at first sight one may think sales are made when the edition is directly launched and there are no more significant sales until next release, right? Well, that is not how this system works, miniatures from a new edition are not completely launched on the first day, there is a phased release process whereby corresponding pre-release hype is generated for weeks/months through avenues such as Warhammer TV and then finally the miniature release takes place. Basically this extends the edition's life-cycle and its impact on sales can last for about 18-24 months approximately.

Bearing in mind the importance of Warhammer 40k editions released each three years, in the image below we can see how the company also strategically launches perfectly timed editions of different brands producing a greater stability in revenues.

Time chart with the universes and releases of the different editions of the Games Workshop brands. Source: @luisferpob Twitter

At the same time the company closely monitor the competitive section (pro-players) of its board game in order to make little adjustments to make it more fair. For example, if almost every pro-player uses an specific miniature in his armies (e.i. tanks) is because it is really worth to be used based on its point cost, this scale of most cost-effective miniatures to play constitutes what in video games is known as the metagame. GAW studies its metagame and every three or six months applies ability reductions or "nerfs" to the top miniatures of the moment and applies ability increases or "boosts" to miniatures that are not played at competitive level (e.i. level up two points of attack and reduce the cost of the specific miniature by x points). This is the company's way to manage its board game that adds the capacity of increasing/reducing the miniature’s stats and thus rebalance those products out of the meta making them more attractive. Additionally, there is an "strange coincidence" because turns out that new miniatures are generally part of the metagame and that boosts the sales of new releases.

Spoiler alert: There is no coincidence here! Every step is very well planned and the company is so much more flexible than it may seem initially.

As a company with a long history, it can be seen how GAW fared in the 2008 crisis and its revenues held up surprisingly well.

Source: TIKR

And this is where the first part of the thesis ends. Do not miss the second part where we will comment on its most important metrics analyzing P&L, BS and Cash Flows, we will also comment on the changes introduced by Rountree and the 180 degree turn of the business, I will give my perspective on certain points such as the recent deal with amazon prime and we will analyze the risks in depth and make a valuation of the business.

See you in part 2!

Finally, if this post has been useful to you, I encourage you to give me your support by leaving a like and commenting what you think of the post.

DISCLAIMER: This is not a buy or sell recommendation, each person must make their own due diligence.

Congrats! Such a good explanation of the business. I would like to ask... Why do you think people will keep buying this products in 10 years? People minds could change quick.

Also, what could be the effect if some consecutive changes in the meta are not well balanced? Could that make people stop playing?

Thanks in advance! I Will read the second part next