$GAW Deep Dive Part 2

Welcome to the second part of the thesis!

Alert: If you thought my coffee recommendation for the first part was correct, I strongly recommend a double shot with this one.

In this part, not only we will see a classic analysis, but also I will express my opinion on many themes trying to add some value.

On this post we will see in detail many important points of the thesis, the index is as follows:

Competitive advantage & other metrics.

Management and principal shareholders

Last update on current situation to make projections easier

Risks in depth

Valuation

Hope this post serves to bring some different approaches to the themes over the table to debate.

Let's continue!

4. Competitive Advantages & Other Metrics

As we already saw in the first part, the main company's moat is its brand. GAW has created a limitless universe with decades of depth and its ecosystem is surprisingly well thought with phased launches of editions, rebalances and virtuous cycles. The company has over 50 years of experience creating fantasy narratives and has generated a mental association between its brand and general miniatures, this happens because it is a close niche and people out of it associate miniatures with Warhammer simplifying their mental map and because GAW is the leading and most reknown company in the industry, but if you do not believe me, just try to ask someone > 30 years old about a miniatures brand and see what happens, I am pretty sure Warhammer will be their first answer a high % of the time, let me know in the comments section at the end of the post!

One of the most relevant points is that GAW has created a loyalty feeling between its customers and its brand. To understand this you have to take into account that GAW's customer base is a bit geeky and dedicates many hours of their free time to the hobby to the point that painting miniatures or playing battles become part of their routine. Long story short, not only the company is almost impossible to replicate, but also has devotees of its products.

Culture is always a vital aspect in every thesis and this will be no exception, in this case, the culture of Games Workshop is completely focused on the long-term.

“Our ambitions remain clear: to make the best fantasy miniatures in the world, to engage and inspire our customers, and to sell our products globally at a profit. We intend to do this forever. Our decisions are focused on long-term success, not short-term gains.”

Kevin Rountree CEO

GAW employees are also involved into the hobby, many of them have grown playing with Warhammer and were customers before being recruited. The company thinks carefully the hiring of its staff and offers training for its employees. This is one of the reasons that explains almost a 90% of its stores are single staff stores (SSS).

GAW operates in a monopoly and is vertically integrated, its distribution centers are in Memphis and Sydney and its products are designed and manufactured in Nottingham. Being present in every part of the process allows GAW to be more efficient.

Besides, the financial position of the company is excellent. GAW does not employ any debt, has 90M in cash and has around 50M in leases. The Group’s leasing activity consists of leases on property, production equipment, IT equipment and motor vehicles. The majority of these leases relate to retail stores. That gives us a financial net cash position of 40M.

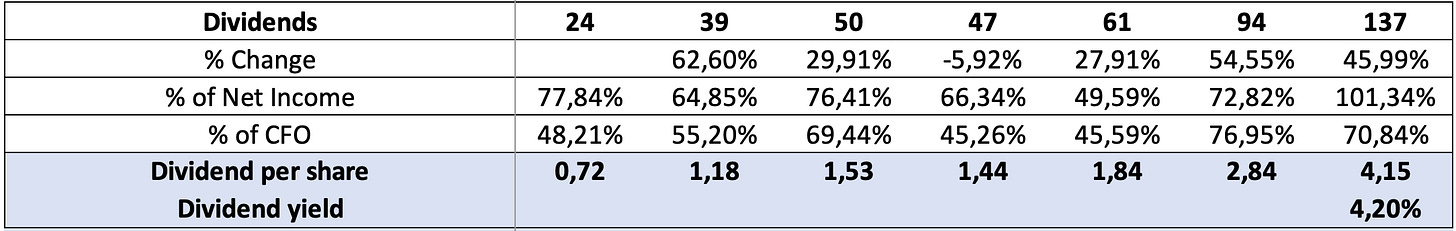

The company's return on invested capital is close to an astonishing triple digit that remarks its competitive advantage in the industry.

Note: Goodwill is basically irrelevant here, the group does not realize M&A and its growth is entirely organic.

“Our continual investment in product quality, using our defendable intellectual property, provides us with a considerable barrier to entry for potential competitors: it is our Fortress Wall. While our 400 or so Games Workshop stores which show customers how to collect, paint and play with our miniatures and games provide another barrier to entry: our Fortress Moat.”

Kevin Rountree CEO

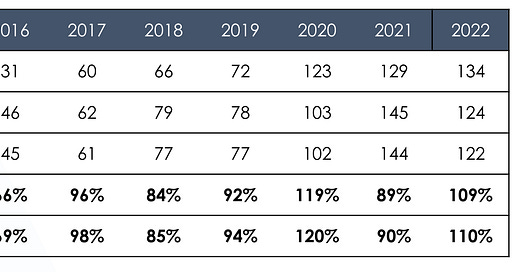

If we take a look at the table with working capital variation, we can observe there was an increment of 35 M in WC during 2021 which partially explains the free cash flow reduction.

CapEx is so low (29 million) that it represents only 6% of the group's revenues, half of which is spent on product development.

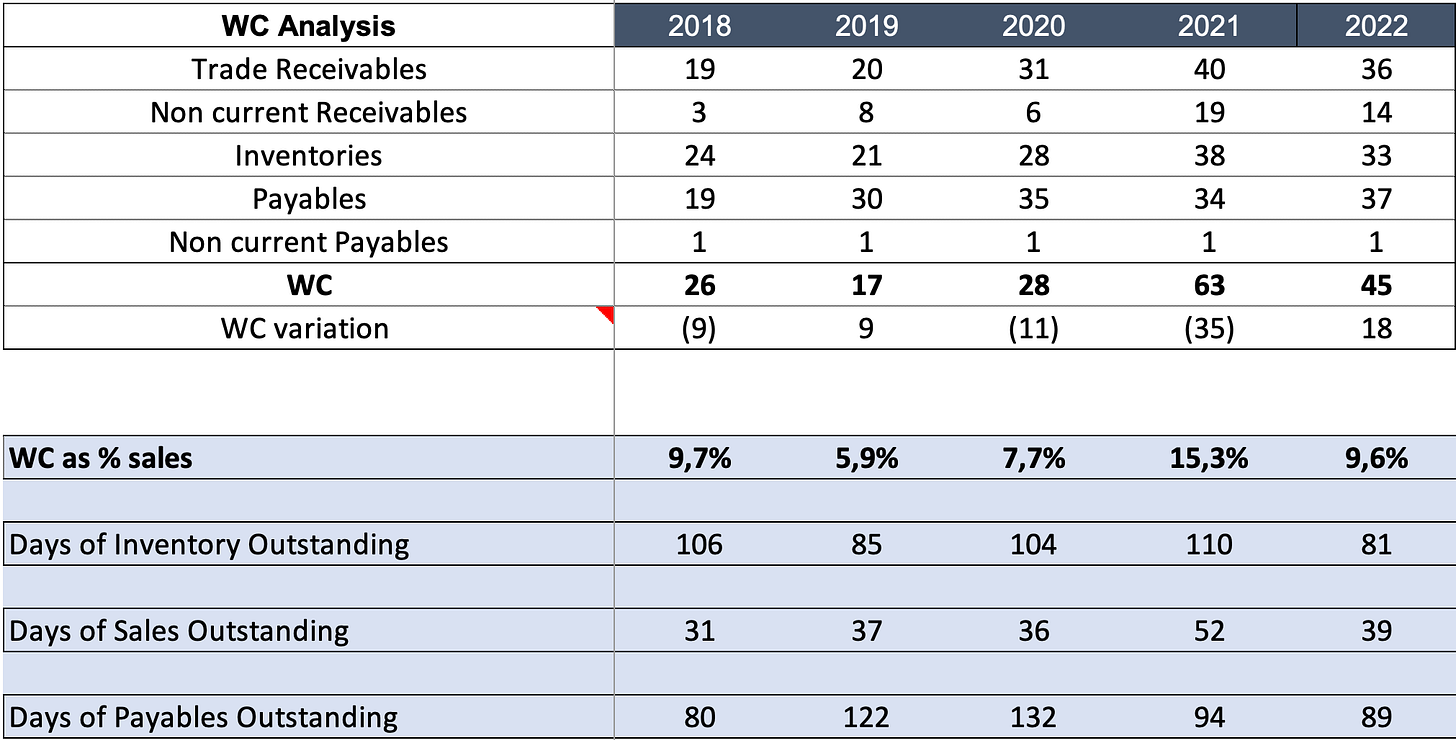

The shareholder retribution policy is based on dividends. Basically the group pretends to return to shareholders every penny after investing what is necessary. Last year dividend per share was 4,15 and it has been increasing since Rountree was appointed as CEO. On average, dividends represent 73% of net income and 59% of CFO yearly.

5. Management and Principal Shareholders

Kevin Rountree was not a new face for the firm, he joined the company in 1996 as an accountant and was elected as CFO in 2008. In the meanwhile he served as Head of Sales of BlackLibrary and Licensing.

Rountree has always been passionated about GAW's lore, he considers the IP to have the maximum quality possible (AAA) and to be completely undervalued. He has been trying to close deals that enhance the firm's position and recently has made some relevant movements such as the deal with Amazon Prime to release a TV series about Warhammer 40K.

In part 1 we mentioned Rountree’s promotion was such a turning point for the thesis but, what changes did Rountree introduce when appointed as CEO?

At that time during 7th edition of Warhammer 40K the board game had become extremely difficult to play and the mental load of playing it was huge. Players even started to consider some rules or attributes the rival could forget to win the battles making the whole game dependent on memorization of many sequences.

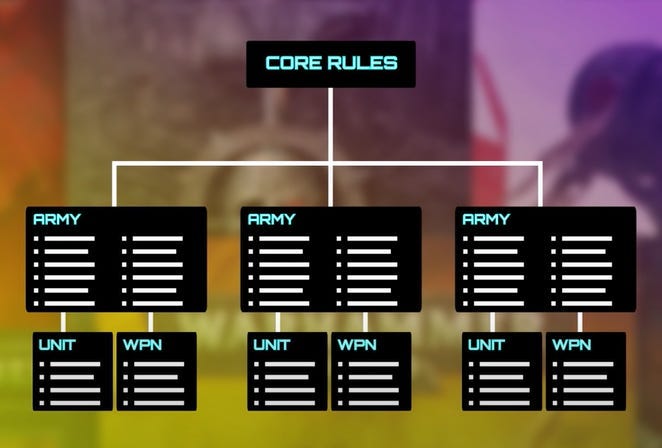

To understand it better, let's do a review of the changes introduced among editions!

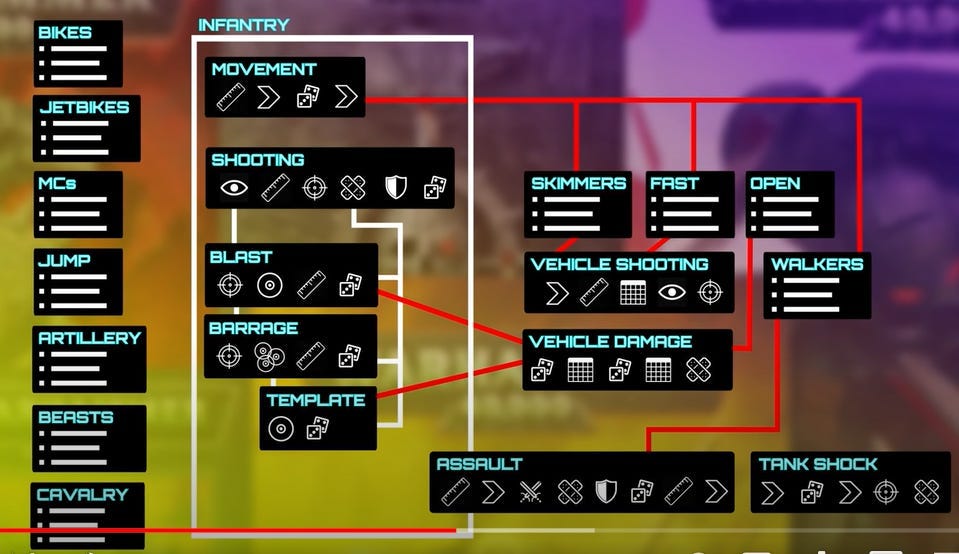

Since its inception, the board game was not thought to be played like that, here is an screenshot of the 3rd edition in which shooting sequences were introduced. Codes and miniature specifications were included in the same dataset and there was a categorization of the miniatures.

Below you can find the firing sequences depending on what you shoot against and what category of miniature you use to attack:

Between 3rd and 7th edition the management introduced changes making the game more complicated increasing the mental load of the player.

In the 4th edition there is a change of the infantry and a different miniature categorization:

This mental load explodes with the changes of the 7th edition. With this release the group introduced suplemments in its game and made it almost impossible to play without memorizing patterns. There were too many interactions to consider and pre-battle preparation was a significant factor.

Besides, you have to add the fandom was complaining about the constant rise in prices without a rise in miniatures quality and felt not listened at all, the situation was critic.

Upon this scenario is when Rountree's promotion took place and he quickly began to think a way to amend the situation. During his first few years he made improvements of miniatures quality and significantly simplified the board game. To satisfy the fandom, Rountree launched in 2016 Warhammer Community, which is basically a space for the fandom to comment updates and discuss some initiatives.

In the 8th edition (first edition release under Rountree mandate) all units were categorized under the same mechanics (movement, attack and defense) and battles were made based on stats comparison. The edition was extremely criticized but turned the board game into a much more playable one. There was a reduction of the sequences you had to memorize and predicting what the other player can do started to play an important role (e.i. chess). In short, the 8th edition completely simplified the board game as it was.

The visual change of the structure is remarkable, 8th edition also lowered the barriers to entry for new players considerably although there were still many ways to overcomplicate the game (i.e. combos, stratagems, etc).

Shareholders & Board

If we take a look at the shareholders list we can observe is basically made by institutional investors. Rountree's % of total shares is minimal, he has no skin in the game and his shares represent less than one year salary. Although I consider this a yellow flag, it is true that with his performance as CEO and having been part of the group for almost 30 years, he has earned the right to reasonable doubt.

6. Update on current situation

More context

After talking to players and following important Warhammer streamers, we can conclude the brand is in its best moment ever and the company is taking some steps to keep moving in this direction:

Prime Video Deal:

Last year GAW announced a deal with Amazon to make a Warhammer 40K TV series that is expected for 2025. Initially this is good news because the lore will be streamed in a platform with millions of users that can become future customers of the group and the market did not last to reflect this in the stock’s price.

Fantasy Old World come back

9 years after the brand ceased operations it will come back with a new edition that can be expected in Feb/March so we can expect some additional push for Q4 (GAW fiscal year ends in may).

The reader must know Fantasy was the second most played brand in 2015 and many players suddenly were left with no game to play and Fantasy devotees have been keeping updating rules to be able to maintain the game out of GAW. So there is still demand for this brand and having 4 operational brands at the same time can provide a greater revenue stability.

This is an important bet to make, Fantasy players may give the first edition a chance but it has to be excellent, they have been waiting for this for so long.

Q1 trading Update

As many stocks from UK we only have 2 reports per year but there are some trading updates that sometimes can provide hints. Before going into it, the reader must know the launch of 10th Warhammer 40K edition took place in July and the quarter goes from June to August so there is only part of the 10th edition effect in the numbers.

The update shows and incredible profit before tax margin! (47%). Here is my point of view on this, remember each channel of income has a different operational margin, I think the 10th edition is being a success and the trade segment has had an important increment leaving independent stores out of stock taking customers to the Online segment (even more profitable) to order miniatures. Remember as well that we mentioned the normalized operating margin of the group is close to 37%, this is a 1000pb increase! Crazy.

Taking this into consideration and the come back of Fantasy in Q4, well, I think consensus may be missing something this year.

7. Risks

On this section of the thesis we are going to see 5 different risks that in my humble opinion can affect the value of the company over the long term:

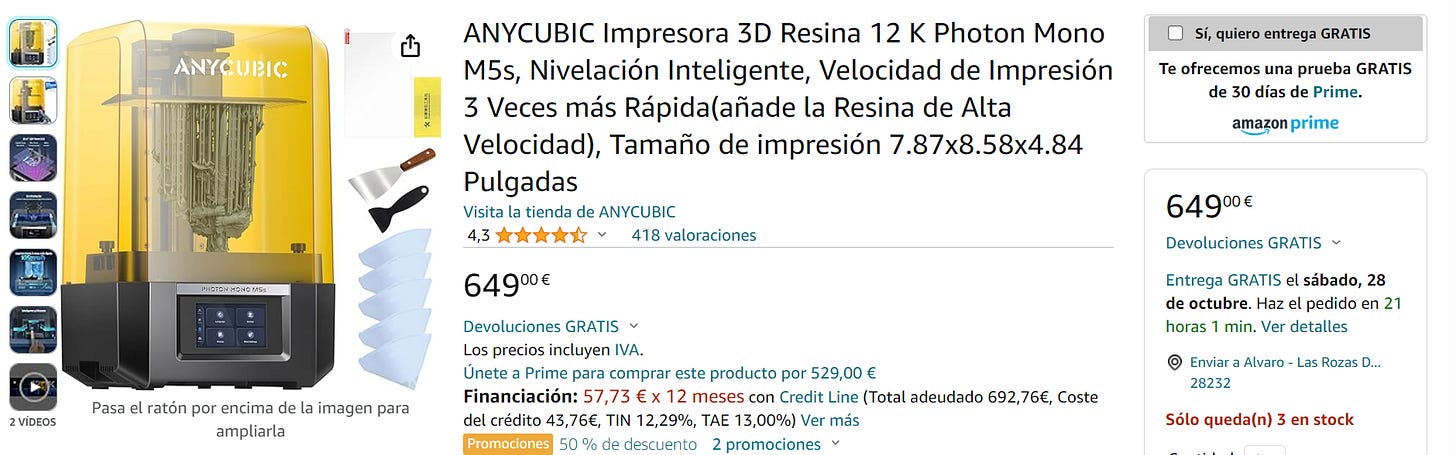

3D Printers

In my opinion this is one of the most important risks of GAW because it directly attacks the terminal value of the firm. The main question here is, why would you spend hundreds of euros in miniatures if you can have good replicas at a more reasonable price? Initially this rationale seems completely logical but the answer is a little bit more complicated than that.

The reality is that 3D printers are used among players but not everyone has a 3D printer at home, what is more common is to ask for miniatures elaboration to a graphic designer or an "expert" in this area that know how to use it optimizing costs.

There are two types of 3D printers: Filament and Resin. The second type is the one that competes against GAW.

These resin 3D printers work the following way: First you need a STL file that is a file format commonly used to represent three-dimensional objects in a format that 3D printers can understand and process. Second, you have to buy good resin to be used during the process such as ABS-LIKE 2.0, then you have to know how to use this resin efficiently (some miniatures are empty inside to save resin) and bear in mind that the outcome can have imperfections so you need to amend them yourself. After processing, you must treat the miniatures with specific chemicals and expose them to a certain type of light.

Alright, let's talk about money! You can find a great resin 3D printer in the market for about 500-600 euros and 1L of good resin can cost around 50 euros. An official army may cost about 2000 euros and to create a similar fake army can cost 200-250 euros, more or less a 10% of the original price.

The difference in price is concerning.

But these printers are not new either, they have been present for a long time in the market and GAW has shown an incredible revenues growth rate increasing miniature's prices, here you are some thoughts about why these 3d printers have not imposed over GAW:

Fidelity.

Customers are really royal to the brand, joking with a player he mentioned to me that knows people more loyal to the brand than to their wives. Jokes aside, it is crucial to understand this, customers have spent such a huge part of their time in the hobby so they have developed a sense of belonging to the brand.Quality.

By far the official miniatures quality is perceptibly better than the fake ones and they are more resistant. Some fake miniatures are empty inside and can break during the transportation or sometimes in the middle of the game.

One important point here is that the idea of playing an on-site Warhammer game represents a fantasy immersion and if, by any chance, a player brings to the table a fake miniature not aligned with what is suppose to represent it worsens the experience of playing to the other player. This depends on the player of course, but you can be sure you will not be called again by the geeky ones.Competitive section rules.

In competitive tournaments fake miniatures are not allowed.Future STL sale optionality.

In some cases Tom Kirby was asked if his business was in jeopardy with the whole 3D printer boom in 2013-14 and he once said that if finally 3D printers destroy the company's market, GAW would still be able to sell the STL needed files to create replicas. I do not particularly buy this point but is good to know management at the time considered there would be some flexibility.Moral Risk.

Lastly, just an hypothesis here if there is a normalization of the use of fake miniatures of the lore. What would you guys think will happen to the hobby? Well, my personal view here is that if there is no main pilar (GAW) establishing order and dictating the rules to play and everyone can make their own specific miniatures and establish different rule's framework this hobby will end up having no sense at all and the most damaged ones will be the same customers that love the hobby.

Deals AAA & Engagement

Here we are going to dive into three topics:

Amazon Prime Deal

VideoGames and IP use

Engagement

Amazon Prime Deal

What is learned about all this? That when everyone thinks the same, for example Nifty 50 is a safe bet, this trend is reflected in prices and betting on it ends up being an almost certain mistake.

Ray Dalio

Not everything that glitters is gold and this is no exception. Even though at first sight the deal may seem really beneficial to GAW I do not see a win-win here. Let me explain my point:

After seeing how the customer profile is and how the narratives are, I see a clear conflict of interests between what a Warhammer loyal customers expect and what Amazon is willing to produce. Warhammer 40K universe is so gore and it is clearly not content for everyone and I do not see Amazon prime getting involved in a production that may cost millions to satisfy the demand of a couple of nerds, I see Amazon trying to create a much more family friendly series trying to expand its viewership and this could be catastrophic. Warhammer devotees have been awaiting for a good TV series production with a powerful budget behind for about decades and if you release family friendly content you are going to dissatisfy your loyal customers that are the same ones that really spend money on the hobby. I see no win-win here and if I were GAW I would have very clear which public I would make a TV series for.

There are also rumors that Henry Cavill may be one of the main characters of the TV series (he is a Warhammer lover also) but there are no official news yet.

VideoGames and the use of the IP

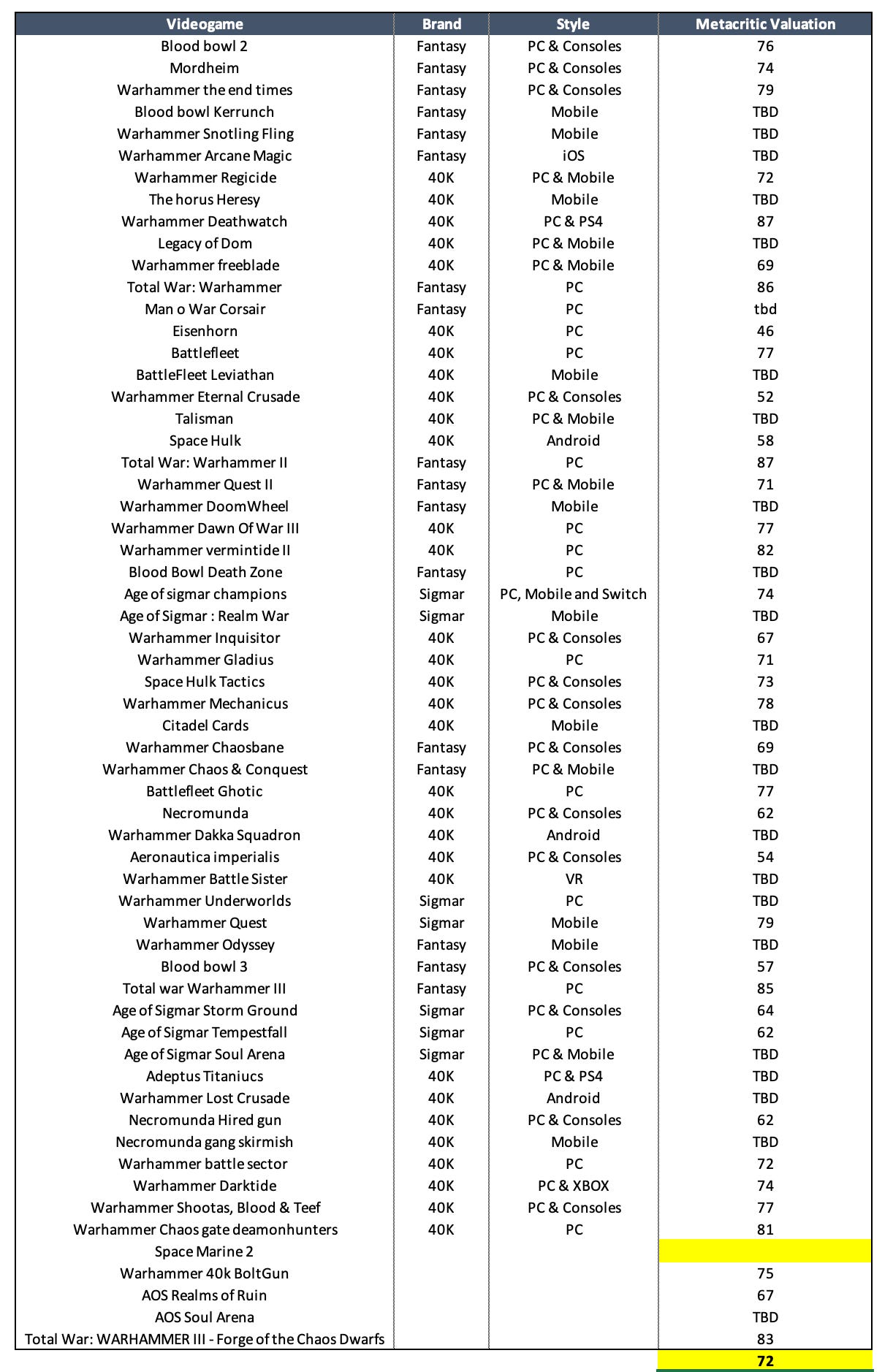

Personally, I do not buy Rountree's claim here either. I cannot understand that you think your IP is the highest quality possible and then you are open to use it to create low quality games. In my humble opinion it is extremely important to link the brand to excellence. As a shareholder I would like to see the IP is only used for excellent projects. On the table below you have a list of the video games released since 2015 with Metacritic valuations. Valuations avoiding Total War, Deathwatch and Space Marine are not even close to what we should expect, some of them are not even determined (TBD).

Sorry but this is unacceptable, do not mislead me here, I also think as Rountree GAW's IP is AAA but I do not understand why you are open to make poor quality stuff with it.

The company recently has been in contact with known producers such as Saber Interactive from Embracer for the elaboration of one of its most played games (Space Marine 2) and this is a trend I would like to see more often. Event though the licensing channel is extremely profitable, this use of the IP simply does not make sense to me, I would love to see something like a Nintendo approach here! Sometimes less is more and Licensing is a kind of double edge sword.

Additionally, in my opinion video games and TV series are perfect paths to reach youth, because I do not see young people I know going into GAW stores but I do see them playing a Warhammer video game very well rated.

Engagement

This is a basic on every brand moat thesis. Right now the hobby is in its best moment and no one can deny the management has taken the correct steps but this should keep being like this. Taking care of the brand, listen to the fandom and associate the IP with excellence are a must.

Time Consuming process

One of the biggest barriers to entry for new customers is the enormous time it takes to be able to play a battle. Remember you have to buy enough miniatures to build an army and then assemble and paint them. This takes days and the number of miniatures needed is not low. One of the recent initiatives taken has been reducing the number of miniatures needed to build an army shortening a bit the time it takes to be able to play.

CEO exit

Kevin Rountree has shown he is an incredible CEO, his exit would be a shock out of the blue but the risk is still there. He is 52 and has been working into the firm half of his life.

Others

The company is exposed to FX fluctuations and does not hedge any currencies. Its based in Nottingham and the 78% of its income is from outside UK. A strong pound may reduce company's income but those currency headwinds are temporal and should not make any difference over the long term.

8. Valuation

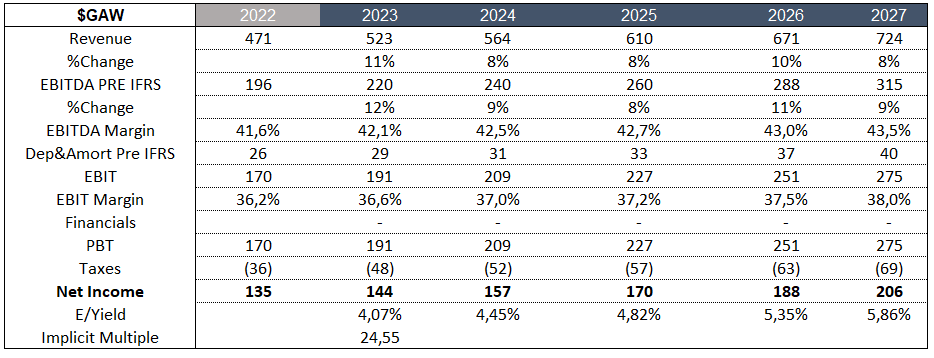

In my opinion this is going to be such a good year for GAW. Despite recession symptoms we are going to have a high financial point with the release of the 10th edition and you have to add the push of the Fantasy's return in Q4. Looking at the trading update (bear in mind it only includes month and a half of the new release) results seem very good, I am looking forward to see the H1 report to really know what happened with margins and to see the impact of 10th edition over a whole quarter although the hype may not be the same. Taking all that into consideration, I think it is likely this year results end up above market expectations.

Note: Uk this year increased tax expense up to 25%.

On the tables below, you can see my projections for GAW. Some clarifications here, first, I only project 5 years because I am not completely sure about the firm's terminal value and this is why the price input gets more importance to me. Even though we have seen it is a high quality company I cannot assure GAW will be selling Warhammers 10 years from now, I do not see this as a secular growth trend where the bet is based on time and patience (e.i. ASML, Luxury, etc). May be the reader thinks other way, if so, please let me know in the comment section what is your point on this.

I consider my numbers are pretty conservative, I also have a more bullish scenario but, for the public opinion I feel more comfortable sharing this one.

Note: I do not even consider the margin expansion from this year commented above in the base case although I see it more than likely…

Lastly, before getting into numbers directly, I would like to share with you what I think is a reasonable intrinsic value for the business: I feel comfortable assessing the company at a multiple of 20x NTM FCF approximately.

Below you can see two different valuations:

DCFs

Multiples

DFCs

For the terminal value estimate I consider three different hypothesis:

Standar calculus of TV = FCF5*(1+g)/(Ke-g)

Note: ERP was obtained from Damodaran Database and g=3% because is the average of global personal consumption since 1970 (Source: World Bank).

You can see the equity value per share remarked in blue.

Also, I made a sensitivity analysis table to understand how the value fluctuates based on terminal growth and cost of equity.

By this method the company seems strongly overvalued.

Considering myself as a PE exiting in year 5 at a 20x valuation.

This may be the DCF I feel more comfortable with.

Stock is still a bit overvalued but close to FV.

Considering myself as a PE exiting in year 5 at a 25x valuation.

This is a less conservative approach but I still see it possible.

Multiple Valuation

Here you are 2 multiple tables based on next year and year 5 to see short term multiple valuation and the IRR that we could obtain according to the multiple used.

Note: The IRR adds the current dividend yield.

Again, 20-22x are multiples I consider reasonable for this business, those give us a 7-9,5% TSR, not such an big break in my humble opinion.

The following table shows a peer valuation in which we can observe GAW's multiple valuation is closer to a IP/Content company's median than to a Toys Company's median reflecting the optionality of the IP of the firm.

Final conclusion

I think the company can grow more than shown in the tables above, the projections take into account that the 40k editions are every three years and are a strong push for growth but I am not taking into account the extra optionality of monetizing the IP or any additional push possible due to a successful amazon series.

The predictability of revenue and terminal value has taken a lot of weight in my thinking lately and so with this company I am more discerning in terms of price. personally I would love to find this wonderful business at multiples close to 15x to give it substantial weight in the portfolio.

The work is already done, just need to wait for the opportunity to come along...

See you in the next post!

Finally, if this post has been useful to you, I encourage you to give me your support by leaving a like and commenting what you think of the post.

You can follow me in twitter if you found the post interesting: @DonChetis

DISCLAIMER: This is not a buy or sell recommendation, each person must make their own due diligence.